Self employed salary calculator

PAYE calculator to work out salary and wage deductions. Additional Tax Deduction for Self-Employed People.

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Instant CPP contribution calculator get all rates and maximums of the Canada Pension Plan for 2021 earnings.

.jpg)

. Learn how to start a self-employed 401k plan with Fidelity by following these step-by-step instructions or call us at 800-544-5373 for guidance throughout the entire process. Book Funnel To Grow Your Business What is an Average Author Salary. If you specified an annual gross salary the amount entered in the pension box will be for your annual.

This Tax and Salary Calculator uses the latest Income Tax and Personal Allowances for 2022 as published by HMRC in the 2021. Proof of Income for Self Employed Individuals. Annual Salary Please note that the results you see on your screen are estimates only.

However if youre self-employed you must file an IR3 individual tax return to claim your income and expenses. Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay. CD Calculator Compound Interest Calculator Savings Calculator.

Self employment profits are subject to the same income taxes as those taken from employed people. This guide explains the rates for the 2022-23 tax year why you might want to make voluntary Class 3 contributions and how National Insurance contributions are. The Bureau of Labor Statistics found that the median salary in May 2018 for a person who classifies as a writer and author on their tax documents is 62170This does not account for all authors though since many write part-time or make much of their income through other means.

Self employed tax and national insurance calculator. Take a look at the documents below to see what you can use to prove your income when you are self-employed. In my example that is 45000 30000 plus 15000.

With this being said if you have an S-Corporation a portion of your salary can be taken as dividend payments which are not subject to self-employment tax. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. If youre employed then recall that federal taxes have already been taken out of your paychecks.

It starts at a 15 rate and rises with your income up to 33. You may get this deduction if you file as a. This Qualified Business Income deduction is a 20 deduction from net business income in addition to regular business expense deductions.

Self-employed guide to claiming allowances for working at home. Self-Employment Taxes. Use our handy calculator to find out how much tax will you will pay Tax year.

GST - If you earn over 75000 per financial year just from your self-employed income ie. 2022 Self-Employed Tax Calculator for 2023. Our salary and dividend tax calculator calculates tax payable on dividends and you can use it to calculate how much tax youll pay on the dividends.

Free Self Employed Guides. The deadline for depositing your employee 401k salary deferrals for owner-only plans is generally by your tax-filing deadline plus extensions. You can find examples of various scenarios applying to self-employed persons and other individuals in Accounting for the wage subsidy - IR1251.

The income tax rates for PAYG earners and self-employed individuals are exactly the same. IRD numbers Ngā tau IRD. Even if you do not owe any income tax you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

Every Canadian citizen who reaches a minimum of 3500 in annual salary and are between 18 and 65 years old have to contribute. Call us to see what Gorilla can do for you. If youre self-employed you might have to pay Class 2 and maybe even Class 4 National Insurance.

More Business and Organisations. Wage and Tax Statement for Self Employed. Login to add to your reading list.

If you received the wage subsidy from your employer as a wage or salary earner read our Wage subsidy for wage and salary earners page. When you are registered for GST you will be required to charge your. That way you can plan your finances with more confidence.

The self-employed hourly rate calculator will work out the bare minimum you need to charge your clients and that figure is on the dashboard tab. To give you a clearer idea of how much of your salary will go toward taxes well break down the relevant expenses in our next section. Self employed tax calculator.

Proving income while self-employed can take a little extra effort if you dont keep yourself organized. Thats your desired salary plus the cost of being in business. Self Employed Tax Calculator 2022-2023.

If youre self-employed you use your individual IRD number to pay tax. Self-employed individuals can make salary deferrals up to 20500 in 2022 as well as an additional 6500 for those 50 and older. Wage and salary earners.

For specific calculations you will need to add information into the advanced section of the Annual tax calculator this includes self-employed tax calculations voluntary NICs payments transfer of tax allowance. If youre self-employed you are responsible for paying your own taxes to the Internal Revenue Service IRS and to your state tax department. The Income Tax Withholding Assistant helps small employers manually calculate the amount of federal income tax to withhold from their employees wages for the 2020 tax year.

Normally these taxes are withheld by your employer. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self-employment income self-employment expenses and pension contributions. Our salary calculator for Canada takes each of the four major tax expenses into account.

You pay tax on net profit by filing an individual income return. Federal tax which is the money youre paying to the Canadian government. The key difference is in two areas National Insurance Contributions and the ability to deduct expenses.

Not including any SalaryPermanent income then ATO will require you to register for GST. See what happens when you are both employed and self employed at the same time - with UK income tax National Insurance student loan and pension deductions. Our New Zealand salary calculator accounts for all of the major expenses and contributions you.

Use this calculator to estimate your self-employment taxes. The 2017 Tax Cuts and Jobs Act includes an additional tax deduction you may be able to take as a self-employed person. More information about the calculations performed is available on the details page.

Use our free salary and dividend calculator to work out your tax if youre self-employed or a freelancer.

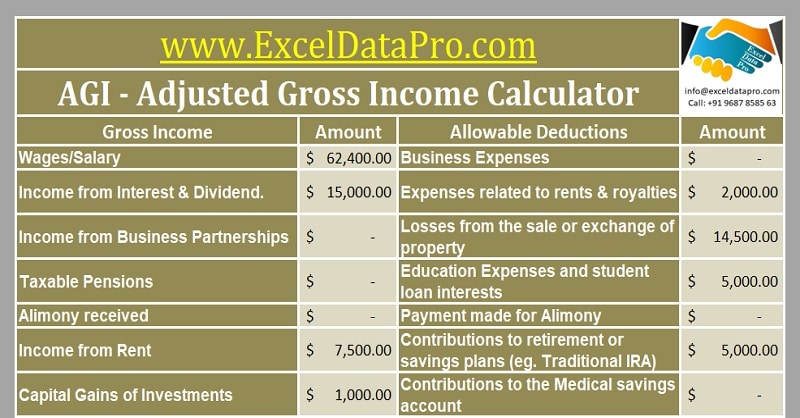

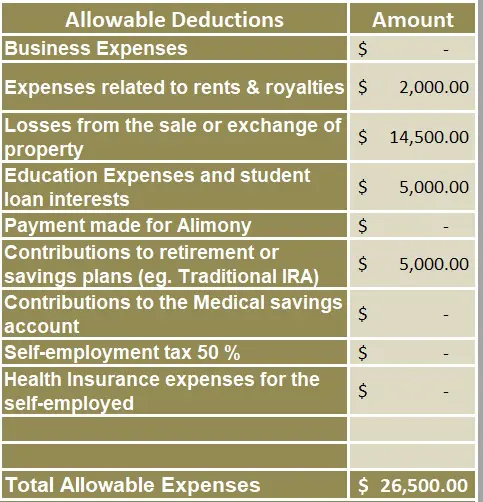

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Paycheck Calculator Take Home Pay Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Llc Tax Calculator Definitive Small Business Tax Estimator

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

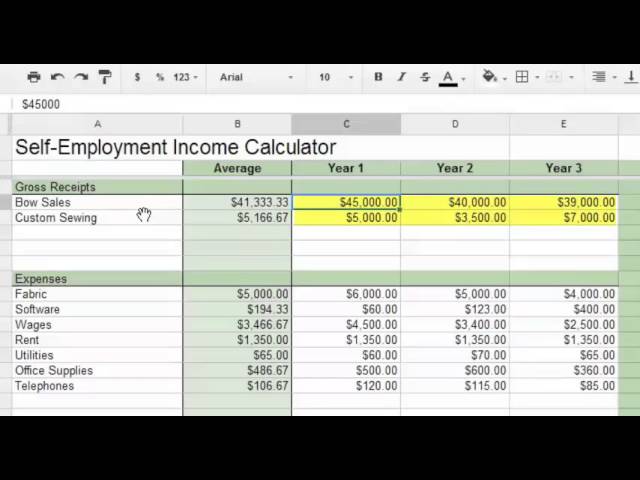

Self Employment Calculator Youtube

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Paycheck Calculator Take Home Pay Calculator

Self Employment Calculator Youtube

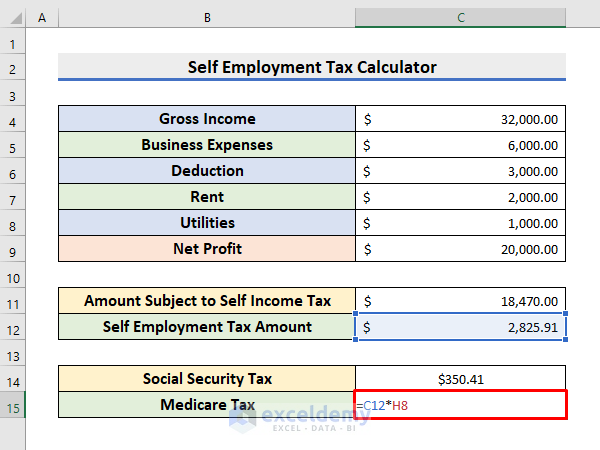

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Schedule C Income Mortgagemark Com

Agi Calculator Adjusted Gross Income Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Monthly Gross Income Calculator Freeandclear

Payroll Calculator Free Employee Payroll Template For Excel