28+ What's my borrowing capacity

Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. New smartphone contract plan.

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

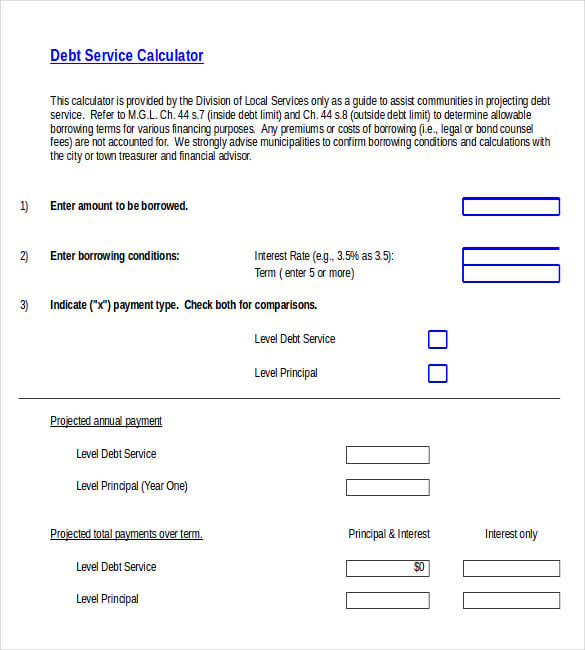

The Maximum Borrowing Capacity Calculator has been developed by HLM Calculators.

. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. So you might need to put on that sports car for another few years while you focus so dont take out big novated leases or. Hi how are you goingWere here to talk about loans again and borrowing capacityVery interesting topic what is your borrowing capacityThat is the borrowin.

Pre-credit crunch the amount you could borrow as a mortgage was largely defined as a multiple of your annual salary. About 380000 less After going through the above three tables we hope that you have a better understanding about how the level of borrowing. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Whats my borrowing capacity. HLM Calculators is responsible for maintaining and updating the Maximum Borrowing Capacity. Examine the interest rates.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. When working out your borrowing capacity lenders will also look at your living expenses things like school fees child care fees etc all have to be taken into account. Factors that contribute into the borrowing power calculation.

This calculator helps you work out how much you can afford to borrow. Estimate how much you can borrow for your home loan using our borrowing power calculator. Compare home buying options today.

Thus as part of calculating your borrowing capacity it is. Now you know your estimated borrowing power the next step is to chat with an Aussie Broker. Your approximate borrowing power is 0.

July 28 2022 in Blog by IndigoFinance. I want to buy a home I want to refinance. Given interest rates at record lows as well as the possibility of additional decreases many people are considering either finally getting in the property market or making an investments in.

Cheapest prepaid SIM only plan. For example you were offered a. View your borrowing capacity and estimated home loan repayments.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. In most cases income from. Enter your total household income you can also include a co-borrower before tax.

Standard borrowing capacity is between. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. This ratio takes your annual housing.

Buying or investing in. He shares a few insider tips to help you improve your borrowing capacity as. The other thing with expenses is personal debts.

Borrowing Capacity is the amount of money someone is eligible to borrow from a lender based upon your income versus your.

2

2

Ex992

Pdf The Mother In Attachment Theory And Attachment Informed Psychotherapy

Free Printable Loan Agreement Form Form Generic

Pin On Credit

Ex992

Exv99

Financial Accounting Ii Pdf Securities Finance Investing

Net Worth Calculator Find Your Net Worth Nerdwallet Net Worth Consumer Debt Personal Loans

Us Consumers Power On Though Borrowing Pickup Highlights Risk In 2022 The Borrowers Power Consumers

H Muralidhar Cv Oct 2019

Exv99

Sample Service Order Template 19 Free Word Excel Pdf Documents Download Free Premium Templates

Don T Underestimate The Power Of Memes R Politicalcompassmemes

Visual Guide To Celestial Isles R Afkarena

Vital Real Estate Marketing Strategies For Realtors In 2021 Real Estate Marketing Strategy Real Estate Marketing Business Checks